Open banking is poised to offer customers a revolutionary new ecosystem, featuring the instant and secure exchange of customer data between financial institutions and accredited third parties such as fintechs. Open banking represents a game-changing paradigm that will significantly enhance user experiences and financial outcomes by providing today’s customer-centric marketplace with an expanding universe of modern, newly connected financial services.

The future of open banking was in focus during April’s virtual Payments Canada Summit, which featured a thought-provoking session titled ‘Open Banking in Canada – Read is NOT Enough.’ Timely insights into what the future holds were shared by the session’s participants: David Hooper, CGI Vice-President of Open Banking and Payments Consulting, Mahima Poddar, Senior Vice-President and Group Head of Personal Banking at Equitable Bank, and Marc Milewski, co-founder and CEO of Zῡm Rails payment gateway.

In Canada today, as the panel noted, we continue to witness a relatively narrow focus on open banking’s technology requirements, specifically application programming interfaces (APIs) and data aggregation, while the required focus on innovative services that deliver new value is lacking. On March 22, 2022 the federal government announced the next step in establishing Canada’s open-banking system with the appointment of Abraham Tachjian as the nation’s open-banking lead. Mr. Tachjian is tasked with pursuing a ‘made-in-Canada’ solution, using the input of industry, regulators and other interested parties (financial technology providers) to design and implement the key pillars of Canada’s open-banking system, including common standards and a liability and accreditation framework for participants.

This is good news in light of the reality that Canada, compared to nations in Europe and beyond, is considered a laggard on open banking. Unfortunately, we have selected a path forward that will limit the ability to bring real value to consumers and businesses.

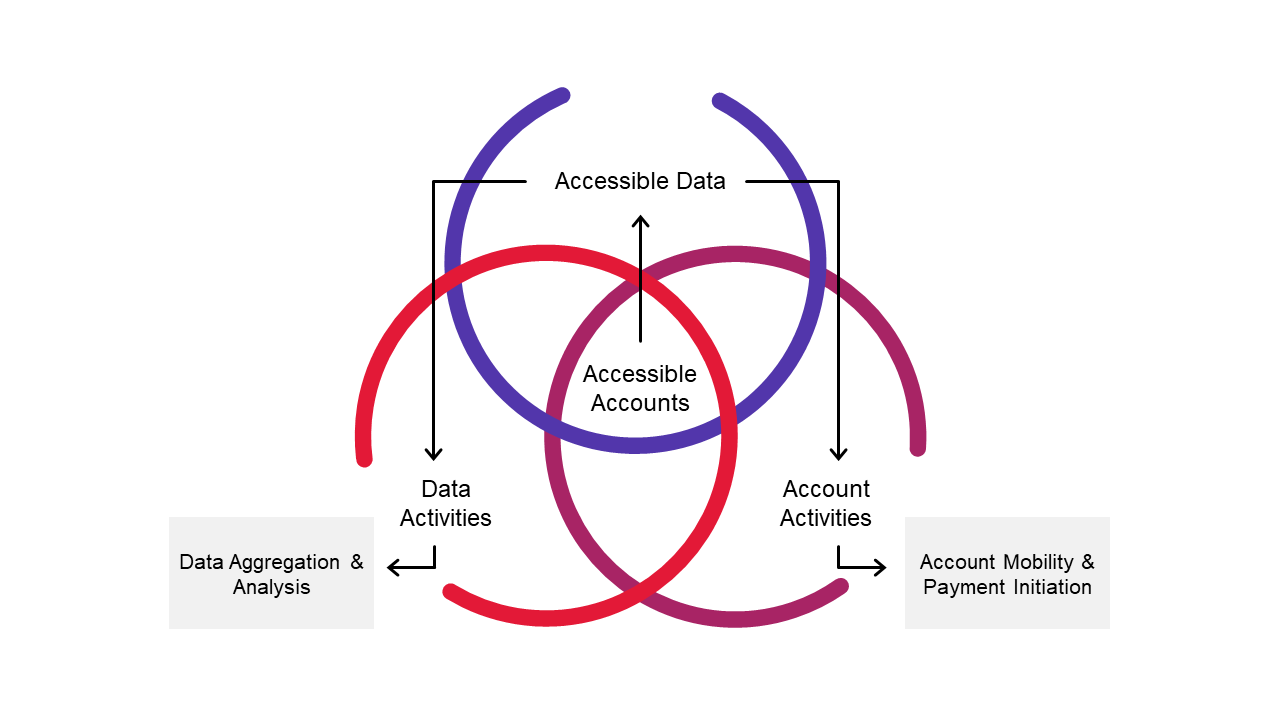

Countries making the leap to open banking are creating new value for customers by moving beyond a ‘read-only’ approach that allows for the simple aggregation and analysis of data and does not allow any meaningful action to be taken. Real value demands the ability to provide customer-facing services that offer advice and recommendations; a ‘write-access’ approach that not only delivers insights but allows the recipient to act, initiate some form of financial activity – be it to transfer funds, make a payment or sign-up for a new product or service.

The ability to access accounts and the data they contain allows for data aggregation and analysis. Being able to act means allowing payment initiation and some form of account or data mobility which usually means the ability to open and close accounts or cancel a service and sign up for a new one.

Source: CGI Inc., 2022.

Canada remains behind as global banks set the pace

European banks are already moving ahead to transform services, launching open APIs and integrating traditional banking organizations with innovative fintechs to deliver interactive services and customized offerings that customers want. These include instant ecommerce payments, cashflow management, financial guidance, product-pricing comparisons among banking competitors and more.

Canadian banks clearly need to move beyond their focus on ‘read-only’ access, says Mahima Poddar, Senior Vice-President of Personal Banking at Equitable Bank. “There is a huge amount of tech investment and foundation build required by the large incumbent banks to get us to open banking,” Poddar notes. “While there are benefits to read-only access, that only gets us part of the way there – payment initiation and data mobility are critical aspects of the open-banking equation.”

Part of the problem could be a significant gap that exists between the theory of open banking and the need for real-world use cases, according to Marc Milewski, co-founder and CEO of Zῡm Rails payment gateway.

“No one really clearly explains the use cases, for example time management and efficiency in the marketplace,” Milewski says. “Everyone should be able to connect their bank account, for example, to a QuickBooks accounting app that can automatically digest your banking information. That’s a really good use case – but it's very rarely talked about with open banking.”

Milewski points to Brazil to illustrate his point, noting that the South American nation successfully rolled out instant payments and open banking at the same time, despite a population 10 times that of Canada and a relative lack of modern infrastructure. Brazil’s game-changing system features QR-code capabilities to enhance the system’s speed, security and convenience.

“They did it perfectly,” Milewski says, “and it demonstrates the need for clear use cases – versus a grand vision of what open banking is or could be.”

Banks need to add value that meets customer needs

The need for open banking and its ability to deliver new value in today’s marketplace is unmistakable, particularly among small and mid-sized businesses seeking help to manage their finances and drive growth amid economic volatility.

“Small businesses are desperately crying for assistance in running their operations – the need for help with reconciliation of payments, for example, is huge,” says David Hooper, CGI’s Vice-President of Open Banking and Payments Consulting. “Beyond giving you a fancy graph that simply says you spent too much money this month, we should be saying: ‘We can help you manage cashflow crunches with additional funds to get through a rough period.’ Customers would embrace such useful services.”

“It's about helping businesses, consumers as well, to manage finances and cashflow and credit cards more effectively,” Hooper adds. “Tell a customer how to quickly put the extra money they saved this month into a TFSA, or toward an extra mortgage payment – that’s adding real value. Making people’s businesses and financial lives better is where you are truly hitting the value marker.” While Canada has maintained a ‘safety-first’ approach to open banking’s data-sharing potential in order to minimize risk, that’s poised to change given the final recommendations of Canada’s Advisory Committee on Open Banking. CGI’s David Hooper praises the broad scope of the proposed framework provided in the committee’s April 2021 report.

“I like the fact that we're broader in scope than some other countries,” he notes. “It covers everything that’s accessible by online banking – chequing and savings accounts, mortgages, loans, credit cards, RSPs and TFSAs. And we will evolve to provide product and pricing comparisons among financial institutions – for example who is offering the lowest interest rates or credit card fees.”

Along the way, he stresses, major banks have an important role to play by “pushing things along – driving much-needed innovation forward at a faster pace and in a direction that is more inclusive of the things that add value.”

Consumers and businesses have a role to play in driving innovation

Beyond banks driving proactive change, they can encourage consumers and businesses to use their voices and play a key role in accelerating the open-banking journey, adds Equitable Bank’s Poddar, noting the success of other countries on this front.

“UK authorities wisely created a budget specifically dedicated to educating consumers on the benefits and use cases of open banking. We need something similar in Canada in order to create a groundswell of awareness and demand,” Poddar says. “We all have a shared responsibility in the industry to do what we can to raise awareness and to advocate on behalf of the consumer, because we've still got a huge hill to climb.” A proactive, market-driven approach among banks, and increased demand among Canada’s consumers, could prove instrumental, given the fact that while open banking is on Ottawa’s to-do list, it’s far from a priority amid prevailing economic concerns that include inflation, rising interest rates and the looming threat of a recession.

“Policy and new legislation take a long time to enact and we can't wait. Let's start moving forward with a vision and a build,” CGI’s David Hooper suggests. “The authorities can come back later and say ‘No, stay inside this box or use these guard rails.’ But if we wait to be told what we're allowed to do, we'll never get there. We've got to move forward and start pushing the boundaries – and that includes a clear vision and framework for what open banking’s future looks like.”

International success stories will provide valuable insights along the way, adds Zῡm Rails CEO Marc Milewski, pointing to Brazil’s success as a prime example of what can be done to bring an open-banking vision to life. “I've seen it in action and as far as I'm concerned, it's the gold standard and something we can learn from.” While establishing an open-banking framework featuring standardized governance, secure data sharing and trusted authentication is the next critical step into the future for Canada, the experts agree that there is simply no time to lose. “We need a consistent and clear framework for open banking and that demands immediate and decisive action,” Milewski warns. “As it stands right now, amid inflation, economic volatility and the very real risk of serious recession, I believe that Canada as an economy will suffer if this is not addressed in the next six months.”

If you’d like to discuss the topics covered in this article, open banking in general, or CGI’s work in this area across Canada, contact David.hooper@cgi.com.

Keeping you informed

Learn more about CGI’s work through our industry insights, news and CSR initiatives.