Annually, CGI leaders around the world meet face-to-face with business and IT executives to gather their perspectives on the trends affecting their enterprises, including business and IT priorities, budgets and investment plans. In 2019, we conducted in-person interviews with 124 client executives in the retail banking sector are focusing on digital channel adoption, the demand for omni-channel services, and the need to manage security, regulation and aging infrastructure.

Customer adoption of digital is the new top trend

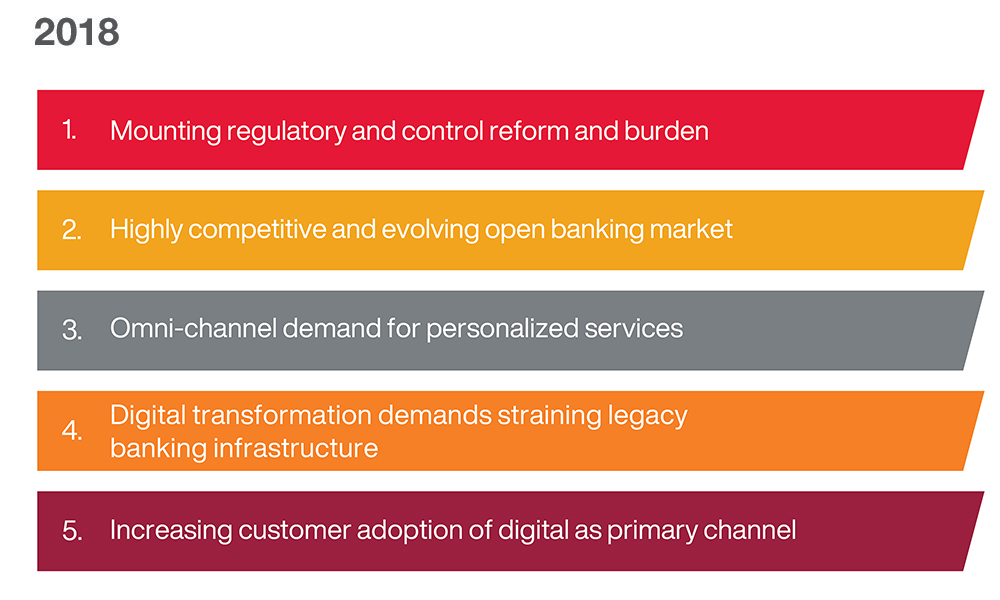

| Increasing customer adoption of digital as a primary channel emerges as the most-impactful trend, rising significantly from fifth last year. It displaces last year’s top trend of mounting regulatory and control reform and burden, which now is second. |

| The strain of legacy banking infrastructure on digital transformation becomes the third most impactful trend, rising from fourth last year. The growing threat of cyber and other financial crimes rises to be fourth highest in impact, up from sixth last year. Omni-channel demand for personalized services decreases from third to fifth in impact. |

|

In 2018, addressing regulatory compliance was the most impactful trend, followed by a highly competitive market, omni-channel demand for personalized services, digital demands straining legacy banking infrastructure, and growing customer adoption of digital. |

![]()

Key findings

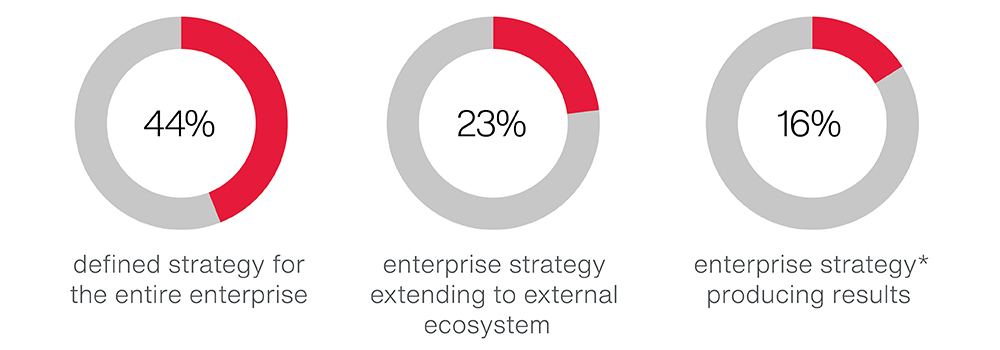

44% have a defined enterprise digital strategy

Ninety-four percent of retail banking executives report having a digital strategy in place this year, and this percentage is slightly ahead of other banking sectors. Forty-five percent have a digital strategy that is operational or actually producing results, compared to 34% across all banking sectors.

Explore how organizations are gaining value from their enterprise digital transformation strategy.

Technology constraints cited as top challengeRetail banking executives cite technology constraints as their top challenge in pursuing digital transformation, followed by cultural change and change management. Cybersecurity and regulatory compliance concerns also remain consistent challenges year-over-year.

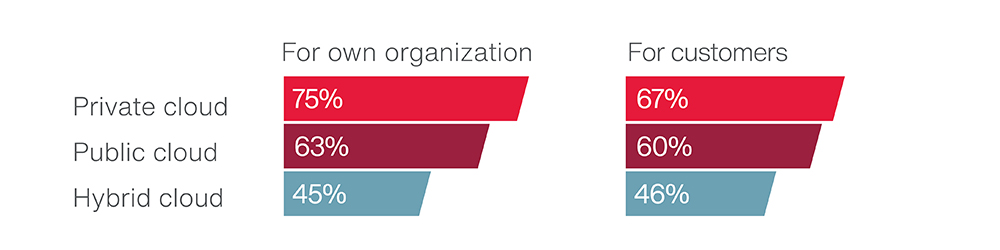

Three-quarters are using the cloud

This year, we asked retail banking executives to share how they are using cloud-based solutions to store and/or process data. Thirty-nine percent are using it to support both their own enterprise and their customers, 32% for only their enterprise, and 4% for customers, for a total of 75% using cloud platforms. When asked if their organizations have mechanisms in place to locate where key data assets are stored in the cloud, 25% do not have clarity on this issue, indicating a potential gap in their cloud approach that may require more attention.

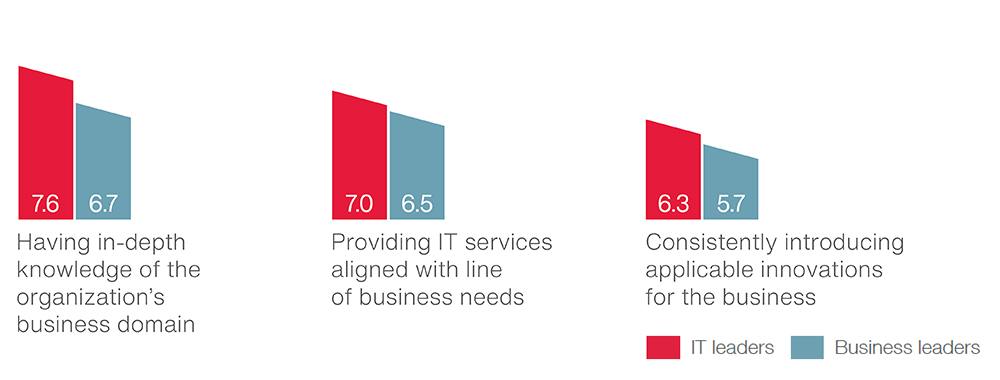

Benchmarking clients’ satisfaction with their own IT organization

For the second year, business and IT executives interviewed ranked their satisfaction with their own IT organizations based on the 10 key attributes of a world-class IT organization. Overall, satisfaction with internal IT is fairly low, at an average level of 7 out of 10. The biggest gap between business and IT leaders in retail banking is with respect to satisfaction with IT’s in-depth business domain knowledge.

CGI can provide clients with a discussion of all available benchmarking, including each client’s positioning, on topics such as digital maturity, IT spending, IT satisfaction, innovation investments and more. Contact us to learn more.

Learn how CGI helps clients on their journey to world-class IT.

|

|

Also see the industry summaries for our 2018 and 2017 CGI Client Global Insights.