In this eight-part article series, we explore Canada’s journey to implement an ‘open banking’ system, the first phase of which is set for launch in fall 2023. This is the fourth article in the series.

To write or not to write? That is the question facing those contemplating the new frontier of open banking, coming to Canada in 2023. Or is it?

The Advisory Committee on Open Banking recommended limiting the initial scope to “lower risk, read-only activities….” What does this really mean? It means that all the interested parties – including banks, credit unions, fintechs and other financial services companies – are framing their open banking strategies for read-only capabilities. As a result, we continue to witness a relatively narrow focus on potential open banking services centred on data aggregation and on the technology requirements, specifically application programming interfaces (APIs), that facilitate the secure exchange of data.

We need to step away from the ancient computer language – whenever I hear ‘read-only’ I think of read only memory (ROM) – which indicates that the data can be accessed and analyzed but cannot be electronically modified.

Yes, this is the reality of what was recommended. But it doesn’t give anyone a complete picture of what will be possible under open banking. It doesn’t call out the fact that the innovative new services we all want and hope for will be greatly inhibited, because people will have little to no ability to take action once the data has been analyzed and a recommendation delivered, or advice given.

Should we stop at ‘read’?

Once a customer has given a service provider (think fintech with a new service offering) permission to receive their financial data from their accounts (held at one or more banks, credit unions, etc.), that service provider will aggregate the data and then do some analysis and provide some kind of advice. At which point the customer will be left on their own to take action.

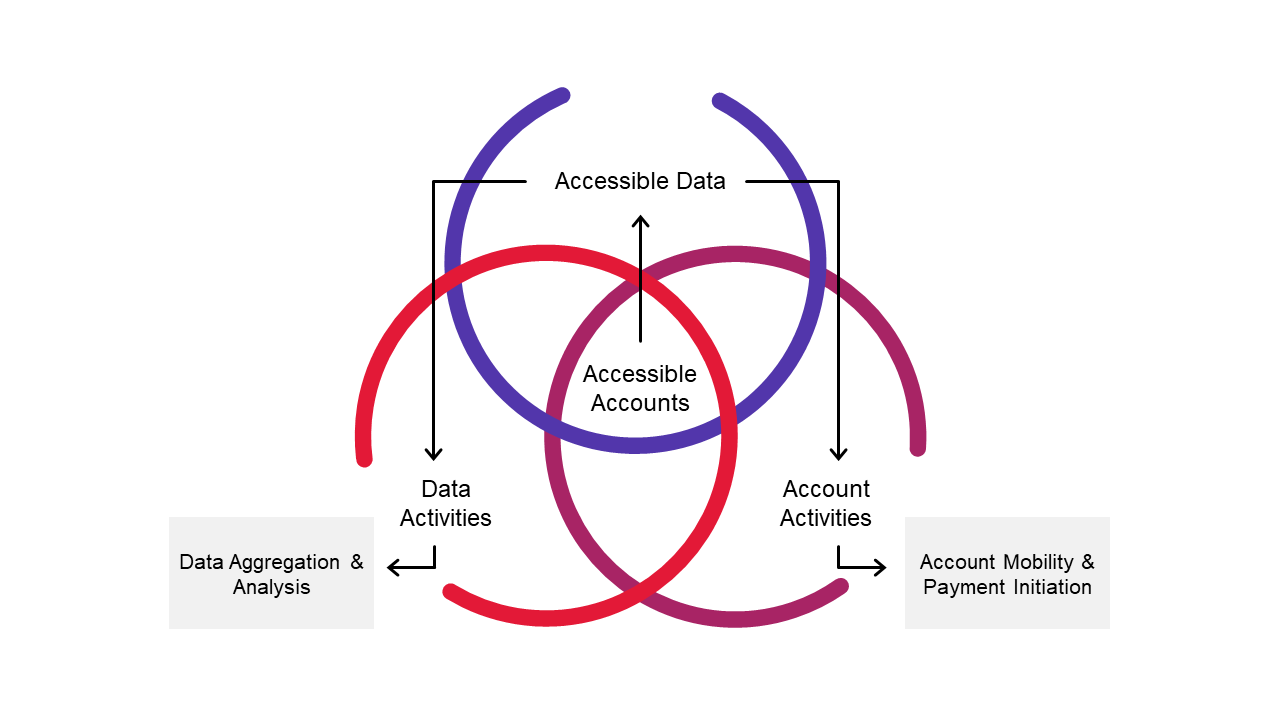

In discussions with our clients and in our industry presentations, we refer to “data activities” and “account activities.”

- Data activities can be summarized as data aggregation and analysis. That’s basically what ‘read-only’ means: get the data, analyze it and make some form of recommendation to the customer or use the data to make a decision.

- Account activities, on the other hand, are the actions taken by the customer or their chosen service provider after the analysis has taken place. These are considered “write capabilities.”

So why would Canada not have those account activities enabled as part of our open banking framework?

I suggest the biggest reason the Advisory Committee recommended a read-only approach is to keep the costs and complexity down, to ensure that the traditional banks and financial institutions with large, complex and older infrastructures would be able to participate.

However, this does not mean that participants should not be looking beyond and preparing for eventual write capabilities. My colleagues and I at CGI believe organizations need to move beyond a read-only approach, which only allows for the simple aggregation and analysis of data, and does not allow any meaningful action to be taken. There are already loads of data aggregation and fancy analysis in Canada. We need to begin thinking beyond these areas and consider what that data will be used for.

The holy grail of open banking – and a truly open finance economy – lies in write capabilities.

What are ‘write’ capabilities? Why are they so important?

To put it simply, write capabilities are the next step that make services more valuable to the customer.

As we have seen in other countries that have adopted open banking, real value is created for consumers and businesses when companies do more than just aggregate and analyze data – when financial service providers gain the ability to not only deliver meaningful insights but support the customer to take action.

The two foremost actions are payment initiation and data portability, whereby customers can make a payment or transfer funds based on the advice or recommendations received, or sign up for a new service, product or account.

I’ll give two examples.

- The most commonly used open banking services in other countries are related to personal financial management (PFM). If your PFM app says you’ve saved $500 this month, it may recommend that you make an additional payment on your mortgage. If you agree, you click a button to tell your PFM service provider to execute the action. That’s a simple payment initiation.

- If you subscribe to a service that monitors the credit card market and you ask the service to find the best card for you, when that service tells you to sign up for new card from another financial institution, you have to go to their website and fill out an application form. Under an open banking system, the credit card monitoring service provider can actually pull all of the relevant information from your accounts, pre-populate the card application form and submit it to the new credit card bank. Once approved, the service provider can then close your existing credit card account. That is an example of data portability: taking data and using it to open a new account and close the old account.

It is easy to see what a fintech could do if they had write access and the capacity to give customers new services and accounts. But for banks and credit unions, having this capability may require some deep thinking to identify the best ways to innovate. What services will incumbents offer that will require not only data but the ability to initiate a payment or sign up for a service or open or close an account?

If we were truly watching and learning from other jurisdictions that are farther along the open banking road, we would know and understand that payment initiation and data portability – taking action – presents the most opportunity to provide services that add value and promote loyalty and, most importantly, adoption and usage of open finance services.

Remember, customers – consumers or businesses – really don’t care about APIs or even open banking. They just want services that help them easily manage their money and financial affairs in ways that are relevant to their needs, circumstances and preferences. They want to know that the services they opt to use work and that they can trust the companies that provide them.

So, the most eye-popping revelation for financial services players is that these types of services, where high value is delivered to the customer, will unleash big opportunities to generate revenues and monetization options. These include subscription fees and one-time use fees.

Final thoughts

To date, the open banking journey in Canada has been confined to a read-only approach. In our opinion, there is a clear opportunity and need for market participants, including the banks, to move beyond this limited blueprint sooner rather than later.

Those organizations that are looking ahead will build and prepare their systems for the time that write-access is available. Some are working on implementing these capabilities now! The recommendation was to not mandate write capabilities; this doesn’t mean they can’t be invoked in a voluntary manner under agreement between open banking participants. On this evolving new front of competitiveness and data monetization, highly competitive and innovative organizations will chart new paths to success.

How CGI can help

CGI is ready to help you. We work with banks across the globe to build digital business models, develop pragmatic roadmaps that support the execution of strategy, and deliver technology capabilities that drive innovation and growth. If you’d like more information on our work in this area or to discuss how we can support your open banking journey, feel free to contact David Hooper, Vice-President, Open Banking and Payments Consulting.

Keeping you informed

Learn more about CGI’s work through our industry insights, news and CSR initiatives.