In this eight-part blog series, we’ll explore Canada’s journey to implement an ‘open banking’ system. While still under development, open banking is poised to take-off. We will share insights on the progress being made and opportunities for the financial services sector, drawing on our experiences from countries where open banking is already a reality.

Today’s convenience economy

It’s no secret that Canadians are digitally-savvy. Empowered by high-tech devices and high-speed internet access, our online comfort zone keeps growing. We’ve become accustomed to a fully digital experience through our interactions with platforms like Amazon, Uber and Shopify and a range of social media channels from Twitter to Tik Tok.

When it comes to banking and managing their financial affairs, retail and commercial consumers increasingly expect the same level of ease and convenience. Whether it’s getting a line of credit, managing cash flow or preparing a financial plan, people of all ages – not just millennials and Generation Z – want a seamless digital experience.

There’s no doubt that the pandemic accelerated the digitization of our lives as businesses, small and large, launched or expanded online storefronts to serve customers stuck at home. Consumer as well as corporate behaviors have changed significantly over the past two and a half years, and studies show that our online activity continues to rise despite the return of in-store shopping or hybrid physical presence.

Canada’s traditional financial institutions (FIs) have responded with a portfolio of new digital services and partnerships to ease our daily life when it comes to making payments (now or later), exchanging money, and performing complex transactions.

But given the profound changes that will continue to unfold, banks and other financial services providers should continue to find creative ways to flourish in the evolving convenience economy, grounded in digital experiences. A more open banking system will create a myriad of new products and services for consumers and businesses, which should ultimately speed up the evolution for traditional incumbents of their digital value chain, with the help of third-party providers.

Evolution or revolution?

Turning our gaze to Ottawa, the federal government has targeted 2023 for the launch of the first phase of open banking in Canada. Earlier this year, they appointed the nation’s open-banking lead, Abraham Tachjian, to develop a made-in-Canada solution. Behind the scenes, industry regulators and the financial services sector have been busy laying the groundwork for open banking, such as developing and adopting an API standard as well as a framework to address data security and liability – effectively creating an open banking framework.

Regulatory restrictions that have kept the Canadian banking system closed to non-banks for decades, will be updated. The goal: to open the doors for more competition and expand the number of participants within Canada’s financial services ecosystem. The desired result is to provide Canadians with access to a wider range of services to help them manage their money and improve their financial wellbeing.

These developments are good news in light of the reality that Canada – compared to the U.K., E.U. and Australia – is considered a laggard on open banking. The U.K launched their open banking in 2018 and today the number of active open banking users in the U.K. has surpassed five million. And, it happened alongside major growth in the U.K. fintech market and new partnerships between diverse financial players.

For Canada, open banking represents a game-changing paradigm for this country’s financial landscape; a twist to the traditional banking model. At CGI, we see it as a great opportunity for banks and other FIs. An opportunity for new forms of collaboration, products and services, and innovation that deliver increased value to Canadians.

Is Canada ready for a truly open-banking future?

We believe it is. While there will still be some catching up to do once the first phase of open banking is launched next year, Canada’s financial services sector is well positioned for this brave new world.

The fintech industry is already exploding with innovative startups and non-traditional players applying the newest technologies to offer niche digitized financial products and services. And, the traditional FIs have exciting digital offerings in place, supported by innovation teams and in-house innovation labs helping their organizations advance with the swift evolution of the market and compete with fierce new digital entrants.

As Canada moves beyond the starting line and competes in the race to open banking, we want to delve into questions that may be top-of-mind for financial services companies as they consider strategies for harnessing opportunities on the near horizon. Questions like…

- What lessons can be learned from open banking experiences abroad?

- How can FIs benefit from an open banking system and use it to differentiate themselves and drive business value?

- In an open banking environment, what are the day-to-day implications for FIs from an operations, technology, infrastructure and back-office perspective?

- What are the possible road blocks and challenges that need to be considered and addressed?

Join us for part two of this blog series, in which we’ll discuss how banks and other financial services providers can evolve and thrive in an open banking environment. We look forward to exploring this issue together.

How CGI can help

CGI is ready to help you. We work with banks across the globe to build digital business models, develop pragmatic roadmaps that support the execution of strategy, and deliver technology capabilities that drive innovation and growth. If you’d like more information on our work in this area or to discuss how we can support your open banking journey, feel free to contact Franck Descubes, Vice-president, Business consulting.

What is open banking?

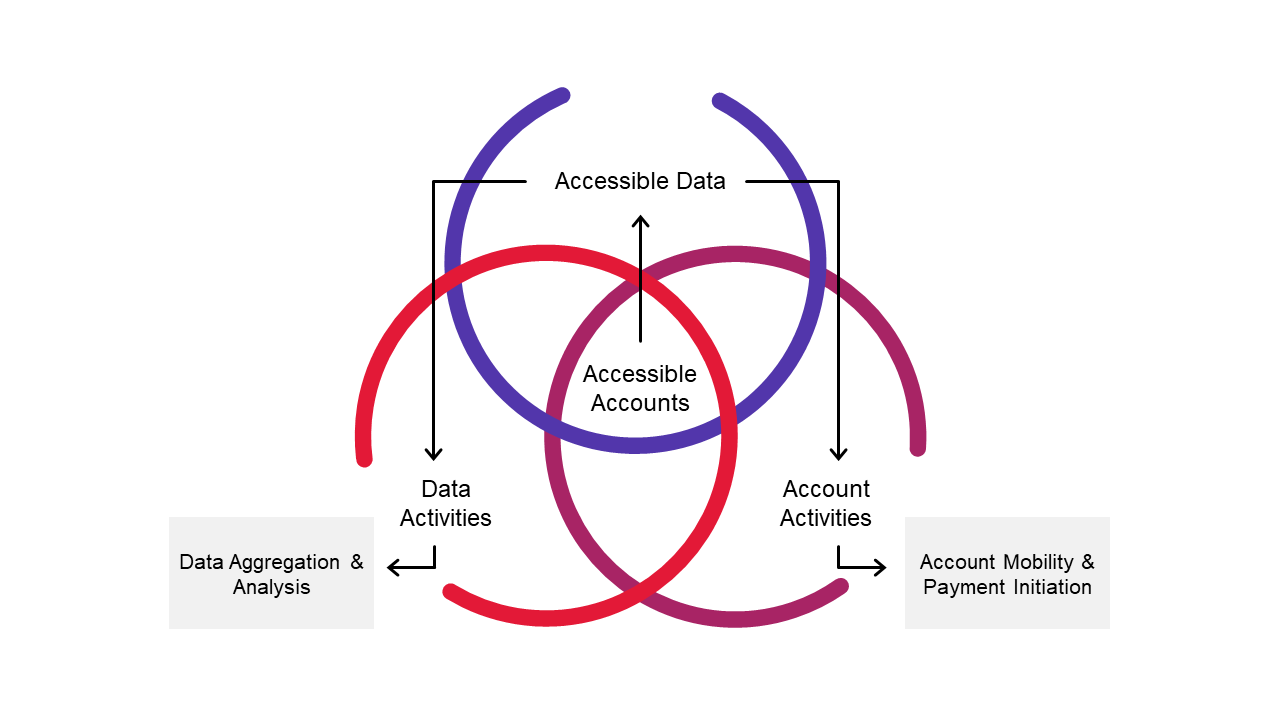

Open Banking refers to the ability of financial services companies and third-party providers to obtain customer consent to access and share financial data in order to develop and deliver innovative, personalized services and products that will benefit consumers and businesses.

Keeping you informed

Learn more about CGI’s work through our industry insights, news and CSR initiatives.