In 2017, a former bank CEO predicted that artificial intelligence (AI) would replace up to 30% of bank jobs within five years. Six years later, there is no sign that prediction has or will come to pass in the foreseeable future. However, artificial intelligence (AI) is, in fact, significantly impacting the future of work in financial services operations.

AI, machine learning (ML), and robotic process automation (RPA) are not new to the ever-evolving world of technology. These technologies have been in development for decades. For specific definitions of each, read a related CGI blog, The future of artificial intelligence is a multi-model ecosystem.

With the arrival and continuous evolution of large language models, however, such as OpenAI's ChatGPT, Google's Bard, Anthropic Claude, and Meta's LLaMA, and their impressive capabilities, these technologies have gained significant attention in service organizations worldwide. In response, conversations about AI/ML/RPA are taking place frequently—from the boardroom to the water cooler—with one pervasive question: How will these revolutionary technologies impact operations, and, more specifically, the future of work?

Chatbot advancements leading to higher customer satisfaction

A critical topic of conversation is how AI/ML/RPA can enhance customer satisfaction. Past implementations of rules-based, "dumb" chatbots often left customers pressing zero, yearning for human interaction.

However, newer AI/ML/RPA technologies combined with human expertise enable the development of advanced chatbots that can swiftly and accurately assist customers, leading to increased satisfaction. When these technologies are built on solid data foundations and integrated across channels, they deliver myriad benefits, including the following:

• Streamlined back-office processes that increase productivity

• Enhanced data modeling for effective fraud detection

• Improved self-service channels

• Development of customer-centric applications

• Tailored and impactful marketing campaigns

By harnessing these capabilities, financial service organizations can deliver an innovative customer service experience that builds trust and long-term customer loyalty.

Augmenting the operations workforce with automation

When assessing AI/ML/RPA technologies, the impact on the customer is of utmost importance. However, organization leaders must consider all stakeholders, including operations and regulators. Since operations plays a direct role in the daily activities most likely affected by these technologies, operations personnel naturally have questions regarding possible job displacement.

In the past, the concern for displacement by automation was not widely felt. For example, in August 2017, 13% of respondents in a Gallup survey were concerned their position would become obsolete, while 87% showed no concern, and in an earlier survey, 26% believed technology would eliminate their job within 20 years. However, the recent hype around generative AI is causing operations personnel to re-evaluate their prior muted reaction, and leaders need to discuss these technologies and their impact openly.

Estimates of the impact of automation technologies on personnel range widely, with some industry experts pontificating that 30-40% of positions would be eliminated over the next 5-15 years. However, applying these technologies should focus primarily on human-machine collaboration that complements and empowers the workforce rather than eliminating it. This workforce empowerment is especially relevant given the macro trend of demographic changes that are reducing workforces in general. In our own 2023 Voice of Our Clients research, 53% of the 1,764 executives interviewed cite that changing social demographics, including aging populations and talent shortages, are highly impacting their organizations. In the banking sector, attracting, acquiring, and retaining talent is identified as a top need and priority.

AI provides an opportunity to retrain the workforce on more complex and challenging work, including additional AI tool applications to further increase efficiency and improve the customer experience. The magnitude of near-term impact will vary by operational area.

AI's impact on financial services operations

Recommendations for managing the opportunities and risks of the future of AI

Getting started

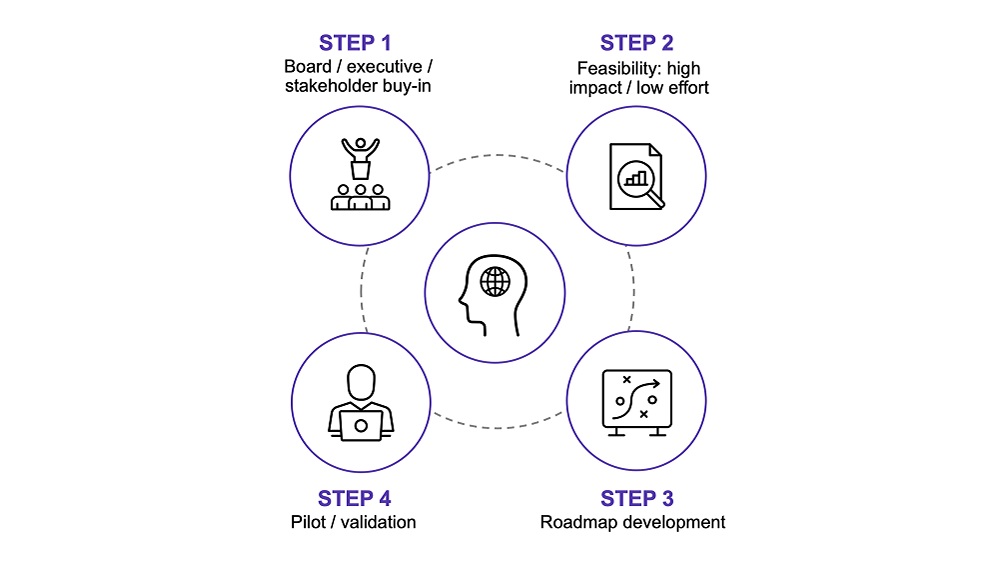

The first step to taking the leap into AI is gaining buy-in from all key stakeholders like the board of directors, senior executives, and compliance, risk, audit, and legal teams, etc. Once buy-in has been achieved, evaluate your operations landscape, brainstorm with your operations teams, and conduct a feasibility study to identify high-impact/low-effort areas that can be targeted for quick wins.

Next, develop a clear roadmap to guide your journey. Then, prioritize, pilot, and validate. Throughout the journey, remember that success is driven by having sound data, data privacy and security, and an ethical framework.

Key steps to follow in integrating AI within your financial services operations

Preparing your operations team early on

Involving your operations personnel early on will lead to higher engagement, more job satisfaction, and greater implementation success. They’ll see AI technologies as a complement, versus a threat, to their jobs through improved productivity and increased customer satisfaction.

Build confidence in your employees by preparing them for any type of impact on their activities. To help ease their concerns about job displacement, provide examples of how AI will help them better perform their day-to-day work activities and be a solution to the IT talent shortages their organizations face.

For example, demonstrate how these technologies will automate routine tasks, analyze large amounts of data and make decisions, assess risk, perform financial analysis in underwriting, and even detect and prevent fraud. AI also will significantly reduce the time they spend tracking errors in human data entries, gathering and distributing reports, performing redundant tasks, and handling customer requests.

It’s also important to communicate that implementing these technologies will generate new career opportunities. As AI assumes tasks, it will give employees time for new activities. For example, they can use their domain knowledge to become analysts who contribute to process improvement and strategic initiatives. Having a robust training and development program to support their transition to new activities will be key.

Additionally, they will have more time to focus on complex and strategic tasks that require human judgment and decision-making, such as analyzing and validating AI-generated insights, addressing complex customer inquiries, and monitoring regulatory changes and potential risks associated with AI-driven processes.

Ensuring a positive impact on the future of work

The synergy of AI technologies and human expertise will enhance the customer experience, lower operational costs, and create new career opportunities for operations personnel. The demand for highly skilled talent will continue to rise, so operations leaders need to get ahead of the technology, building strategies and roadmaps, communicating openly with their teams, and planning for upskilling.

Taking a human-centric approach to the future of work by involving employees early on and showcasing how technology empowers them to drive productivity, customer satisfaction, and long-term success will foster among them a desire to learn and upskill while alleviating their concerns about job displacement. For executives, it also will help alleviate their challenges with workforce shortages currently impacting their organizations.

CGI is working with financial institutions across the globe to help them assess and implement AI strategies, roadmaps and technologies, enabling them to embrace the opportunities and address potential risks on their business. Feel free to reach out to us with any questions you might have on the insights we have shared above or CGI’s experience.

Learn more about our CGI Australia Banking and Finance solutions.

Back to top