In the digital era, the need for banks to pivot quickly, adapt to rapidly changing customer expectations, and comply with increasing regulation has increased significantly. At the same time, banks face the challenge of legacy business models and systems that are not easy to replace or enhance. The result is a continuous balancing act of investment, change and operational management that many find difficult to manage.

Often, attempts to build new digital customer channels result in operational processes that are fragmented across multiple systems. This leads to increased complexity and reduced productivity due to an overreliance on manual operations to plug gaps in the digital landscape.

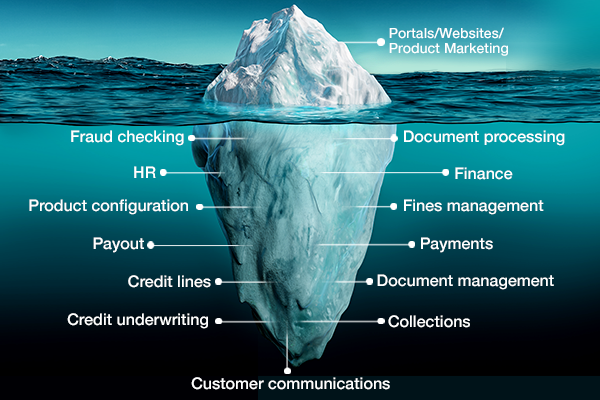

Overall, banks face the challenge of contending with what has been referred to over the years as the “digital iceberg.” Above the water are new online sales and service channels that are visible to customers and third-party networks and provide a digital veneer. However, below the water, the business remains hampered by a large amount of technical debt and manual processing, which impacts performance and customer satisfaction.

We call this focus on surface projects “digital accessorization.” Many banks are focusing on front-end projects that engage customers through digital channels without modernizing their underlying core systems.

If the bank’s underlying operation is not harmonized digitally in line with its front-end channels, then it will be difficult for the bank to increase efficiency, improve time to serve, and reduce costs. The negative results—from delayed lending decisions to an overall poor customer experience—will damage the bank’s brand and limit its growth.

According to the 2021 Voice of Our Clients (VOC), only 35% of retail bank executives report achieving expected results from their digital strategies. What is the solution? How do banks navigate the digital iceberg?

The answer is holistic digital transformation. As technology becomes further embedded across the entirety of a bank’s value chain, transformation programs should pivot from discrete technology projects to business transformation initiatives that embed underlying cultural, operational and architectural changes.

Building an intelligent automation ecosystem that features automated core processes and value streams is an important strategy to reach this holistic transformation. In fact, our 2021 VOC research shows that, in examining the attributes of those bank executives who are achieving expected results from their digital strategies, they are more likely to embrace all forms of automation compared to those who are still seeking results. They also have made significantly more progress on the complex and value-added forms of automation.

Such an ecosystem brings together key business areas of the bank, including operations, support functions, contact centers, and customer interactions, along with multiple layers within each area, including:

- Interaction layer: Devices and front-end channels virtual agents, and a low-code app factory

- Orchestration layer: Business process management, scheduling, event streaming and process supervision

- Execution layer: Process automation, business software, IT applications

- Performance layer: Network and security, data and insights, APIs

Within each business area and at every level, data analytics and artificial intelligence are used to drive insights while robotic process automation is used to automate processes. In addition, business process management tools facilitate orchestration, while cognitive agents digitize data to provide true value-driven, outcome-based interactions with customers and users.

What are the outcomes of such an ecosystem? The benefits are many, including data-driven decisions, scalability and performance, operational excellence, a superior customer experience and greater shareholder value.

An intelligent automation ecosystem enables banks to avoid digital icebergs and operate an integrated business—from end to end—without the need for a complete overhaul of its IT environment. The bank can move forward, reaping the advantage of modern technologies like intelligent automation, without the cost of replacing existing systems.

CGI works with banks across the globe to build digital business models and intelligent automation ecosystems that enable them to reinvent their businesses, move ahead of the competition, and drive sustainable growth. For more information on the capabilities of an intelligent automation ecosystem and our work in this area, feel free to contact me.