In the last 30 years, technology has become an integral and inseparable part of the business ecosystem, but measuring the return on investment for much of the spending has become nearly impossible. For Chief Financial Officers (CFOs), the game is changing.

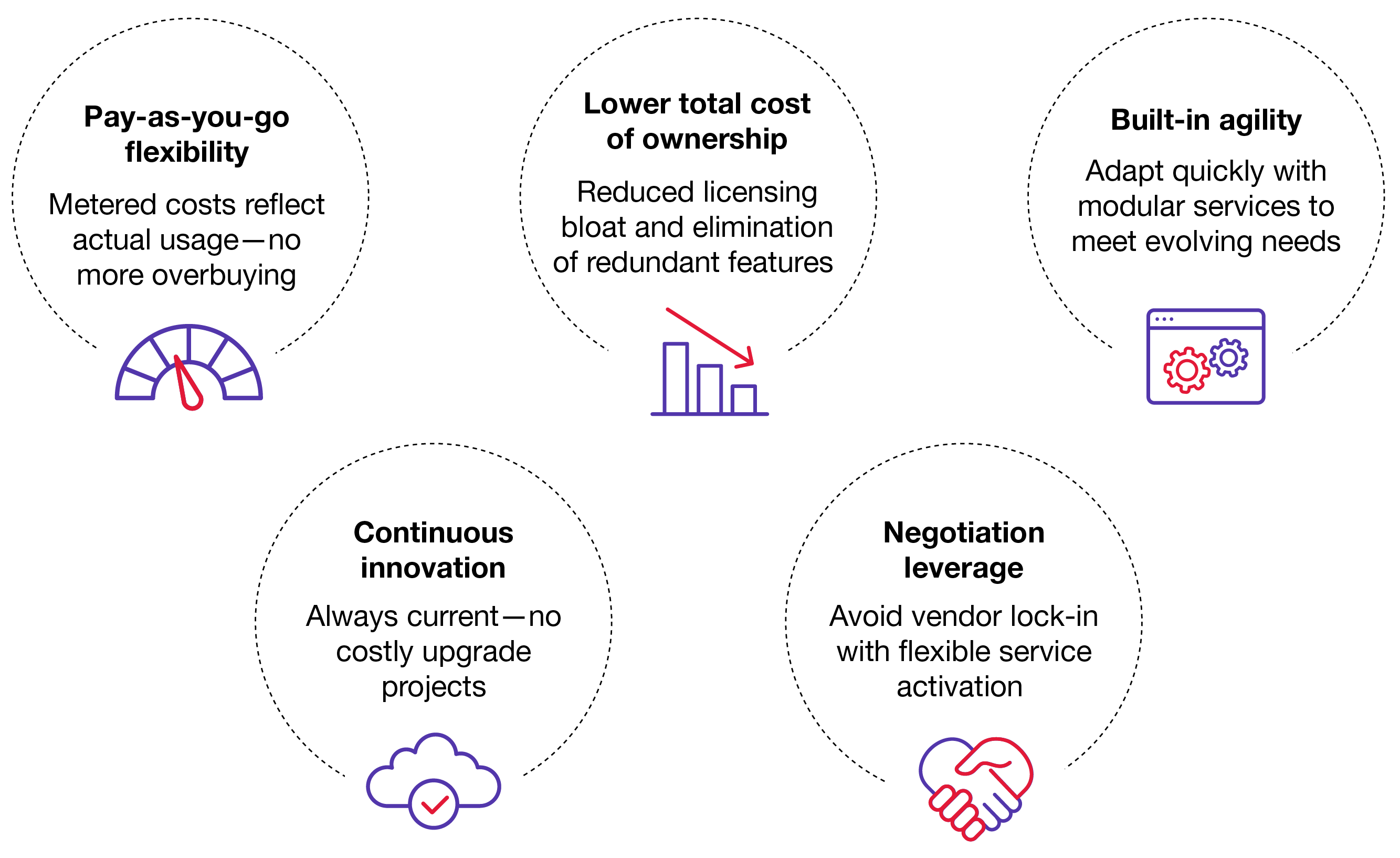

The industry is awash with buzzwords, and “cloud” is on the leaderboard. Thrown around in sales pitches and demos as if the meaning of the word cloud is succinct and precise, most executives have become immune to its allure and deaf to the intricacies that, when fully understood, can bring tremendous value to their technology investments. Here are some of the hidden gems the cloud can bring to an organization, much to the delight of the CFO.

What is a true cloud solution?

A cloud-native solution typically comprises hundreds or even thousands of microservices that can deliver any number of business outcomes simply by orchestrating them together in various ways. The microservices interact with each other through pre-defined integration methods or event streaming, maintaining a concept of microservice autonomy—the “so what” factor of microservice autonomy is vast when considering the financial benefits.

Traditional software platforms were built to deliver n number of business functions, and the solution may contain y number of sub-systems to produce the desired outcomes. In most scenarios, the platform components were bundled in with no ability to opt out, leaving organizations no choice but to pay for redundant technology functions they never planned to use. In either case, the “wasted” expense associated with traditional monolithic and cloud-deployed technology solutions has frustrated CFOs for over a decade.

Cloud-native solutions allow you to pay for what you need

Cloud-native solutions introduce another major shift that further differentiates the cost of technology from the business investment in software licensing. In a SaaS delivery model, cloud computing and the need to keep a platform secure, scalable, available and resilient are costs that should be roughly equivalent to a client’s traditional hardware, software and resource support costs. However, business investment in software licensing transitions from a metric-based license model, like users, to a “meter”-based consumption model for business services and outcomes that fluctuate up or down over time based on the changing needs. The key benefit of this metered approach to business service consumption is that it allows CFOs to reduce spending in the aggregate and take advantage of enterprise technology investments targeting core functionality. While the unit cost for individual business services may be marginally higher, clients only pay for what they use, keeping net costs lower overall.

Cloud offers the flexibility to evolve

As if the previous two benefits weren’t enough to thaw the icy façade of software contract negotiations, CFOs may also recognize real benefits in the strategic value of cloud-based business services. Built-in software competition creates a favorable negotiation lever that can be used in multiple ways. Terminating contracted software, especially if heavily embedded within the business landscape, takes years of advanced planning to ensure that “Notice of Termination” and “Contract Termination” dates aren’t missed. Turning on a service on an already licensed production platform, even if only for interim use, can dramatically reduce the timeline associated with moving away from the current solution. CFOs can avoid unfavorable contract renewals resulting from an inability to exit a bad contract due to contractual time constraints.

Another arrow in the CFO quiver is to leverage business services to support agile or iterative development programs. Enterprise IT strategies are often large, multi-faceted initiatives designed to meet the needs of multiple internal business areas. Prioritization of functionality often remains fluid throughout the journey, and the actual and opportunistic unintended costs add up quickly. Turning on cloud-based services to enable quicker business value as a short-term solution can reduce the risk of significant enterprise investments while minimizing throw-away costs. It also improves iterative flexibility so business leaders don’t have their hands tied by the changing demands of multi-year projects.

The ease of keeping software current

Few things annoy CFOs more than the cost of maintaining software investments. Software vendors have long struggled because their installed base needs help upgrading versions at the same velocity as their sales prospects expect new functionality. The actual cost to clients is the time they spend evaluating, scoping, and prioritizing software maintenance activities while still investing money and resources in moving the business forward. The inevitable result is that no client can mirror the release cadence of the software vendor, and eventually, moving to the latest release becomes an enormous investment.

Cloud-native rewrites the narrative on software currency. While no one can predict the next major technology transformation evolving from cloud computing, the reality of a platform designed with a limitless set of underlying microservices is that software currency is almost always assured. Cloud platforms are built from underlying components that are constantly evolving to fill the expanding needs of the global marketplace. As they expand their functionality, the services consuming those components must similarly evolve. The symbiotic relationship of components means that one cannot get out of phase with its neighbors, and one cannot provide value without the other. That means the investment CFOs approved today will have the same future business relevance if the software provider wants to compete and win business with their platform.

Long-awaited relief

True cloud-native solutions are an incredibly complex assortment of technology components that no CFO should have to understand as part of their day job. The inexplicable and inexorable reality of microservices and the business outcomes they can generate are, in fact, a modern miracle of technology. But for CFOs, true cloud-native platforms can deliver the long-awaited relief from traditional software licensing bloat and the inability to escape redundant functionality.

CFOs are critical members of the buying team. While licensing negotiations will continue perpetually, the newest vendor platforms pay homage to the needs of finance leaders everywhere by transforming how their clients package, deliver and consume software. Software currency, lower cost of ownership over the product’s lifespan, improved business flexibility, greater negotiation power and pay-for-what-you-use metered costs are helping CFOs make strategic investments in cloud-native platforms a go-forward requirement.

As the dust settles on the modernization of traditional software platforms, CFOs who understand the strategic value of true cloud-native platforms and mandate their adoption will have a leg up on measuring actual return on investment for technology and the business. Metered costs, reduction in solution overlap and elimination of redundant licensing costs should clarify the actual cost of doing business. An added benefit is the ability to measure improvements in business outcomes, providing further justification for their ultimate value.