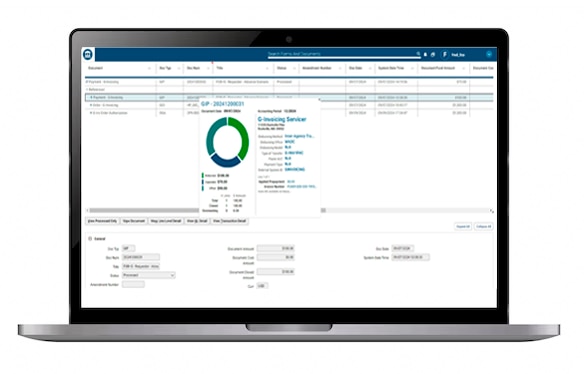

Federal financial management with Momentum®

Federal

financial

management

executives

and

managers

continue

to

face

many

interconnected

challenges

with

financial

systems

technology,

human

capital

management

and

budget

uncertainty,

challenges

that

the

President’s

Management

Agenda

(PMA)

only

sharpens.

An

enterprise

strategic

approach

with

clear

objectives

that

are

aligned

with

practical

and

achievable

tactical

plans

and

goals

provides

the

best

opportunity

to

meet

...

Learn more Federal financial management with Momentum®