Experience across multiple change programs involving a range of technologies has taught me something important: be wary of projects where there is too much focus on the digital side of transformation and not enough on the people or the problem to be solved. While it is human nature to hope that technology alone will solve our business challenges or increase productivity, hope, as they say, is not a strategy.

Despite their promise to revolutionize life as we know it, blockchain, non-fungible tokens (NFTs), the Metaverse, and augmented reality/virtual reality (AR/VR) have not disrupted the way the world (or the insurance industry) operates. As a result, business leaders are skeptical of new technology initiatives, including ones that involve generative artificial intelligence (GenAI).

As a technology optimist, however, I know success is possible and that technology gives us an opportunity to make a difference. How do organizations improve their chance of seeing a return on their investment using innovative technology, like AI? And how do we help business leaders feel confident that they are building an organization fit for the future?

A human-centered approach: the key to a successful IT transformation

Initially, it’s important to step away from the excitement that new technology generates and instead focus on the human side of the equation, including the business itself. Start with questions that focus on the people within the business and customers served by the business. It’s vital to identify the problem to be solved, or the improvement to be made. Too often, projects fail to define that purpose succinctly and confidently, even at the start.

A common misstep is relying on management’s assumption about what benefits will be delivered, rather than listening to the people most impacted. It’s important to follow up with those who can honestly answer the questions, “Will this project really make life better for our employees or clients, or are we being driven by efficiency gains and cost savings alone?”

The foundational step for a successful transformation is to challenge ourselves to make a difference and then transform. Most digital technologies are bandage solutions that merely bury out-of-date processes and systems rather than fixing the challenges with the underlying process. The digital solution may have some initial benefits, but the underlying problem is handed down to the next CEO or CIO.

For instance, AI is currently used to help uncover insights from unstructured documents or poorly designed data stores. An example is CGI Elements360 Workbench, which leverages AI to help underwriters sift through large amounts of unstructured information to identify the most relevant risks. It provides underwriters with tools, data, and enhanced workflows to transform how they prioritize, allocate and process risk.

While applications like this create value, there is still a need for innovative technology that addresses the fundamental problem of using unstructured documents and disorganized data sources.

Innovative digital solutions start with rethinking paper-based processes

Throughout many digital transformation initiatives, millions of dollars have been spent digitizing paper forms and processes. What’s been missed is the opportunity to rethink those processes beyond their original paper-based purpose and design. As a result, the digital alternatives often look like a paper form with a shiny technology veneer. We are left with the underlying limitations of paper-based thinking and the legacy systems that go along with them.

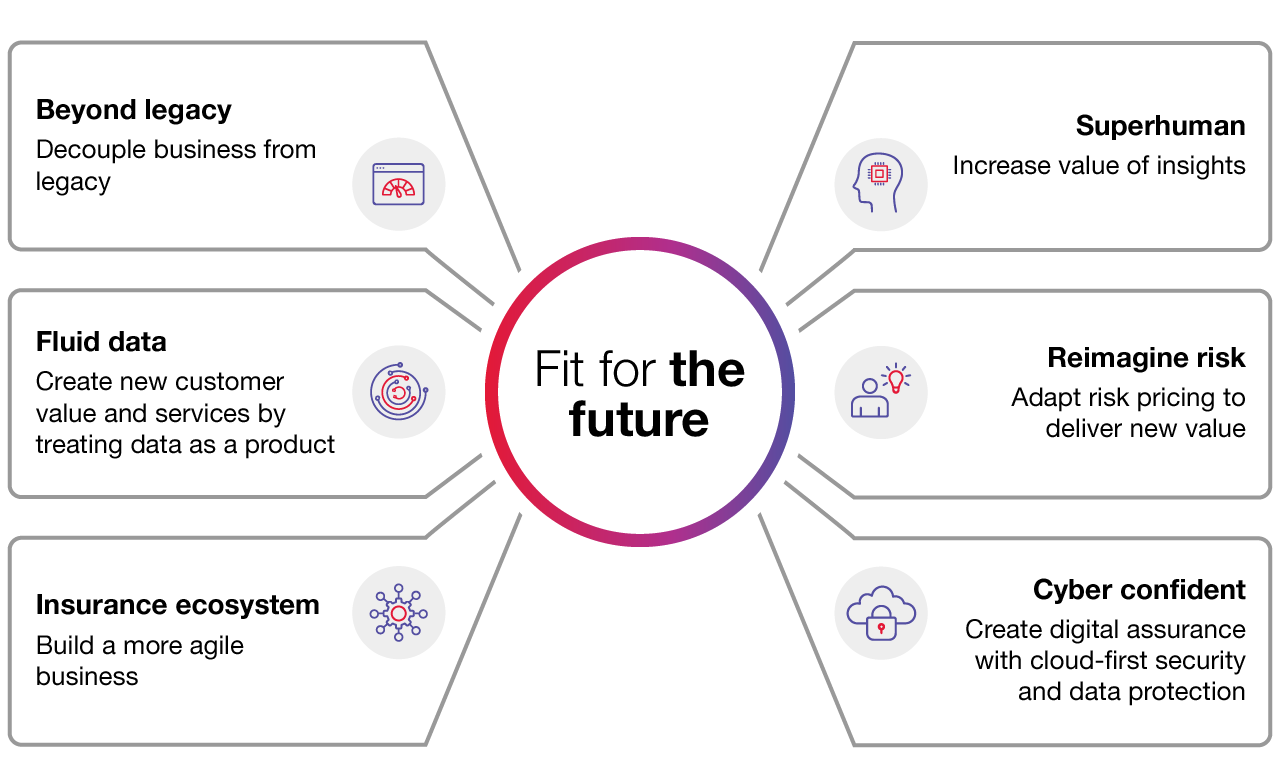

It is time to pull off some of these digital bandages and explore how to be more innovative. IT transformation can feel daunting in the face of constant pressure to reduce operational costs. However, to address this challenge, we use a framework that covers six key strategic focus areas we believe allow organizations to define a fluid operating model. Because every organization is at a different level of maturity across these areas, our model is adaptable. By examining all six elements and making sure we understand the problem to be solved for each of them, we deliver a better and more robust outcome.

The super six: key focus areas for preparing for the future of insurance

- Think beyond legacy: Decoupling business from legacy to create a more agile business model reduces the painful cost of business change. It also increases your speed to market and lowers operating costs.

- Make your data fluid: By treating data as a product, you can create new customer value and services and drive profitability. Leveraging your data helps you better understand your market, business, clients, and risk portfolio.

- Create an insurance ecosystem: Building an agile business using composable architecture and third-party solutions results in a nimble business model. As a result, you can win more business by innovating products faster and engaging clients in new ways.

- Become superhuman: Increase the value of human insight using AI to enhance the client and employee experience. By reducing manual tasks, your people can focus on more valuable work.

- Reimagine risk: Adapt risk and pricing services to deliver new value from proactive products and services. Better insights, control and flexibility of pricing, and risk management enable you to write more of the right business.

- Be cyber confident: Create digital assurance by building in cloud-first security and data protection. Protecting your business data and reputation drives new ways of working in the cloud with clients and partners.

In my next blog post, I’ll analyze these six areas in more detail. I’ll also discuss why building around a people-first approach is crucial, and why most organizations will achieve more by moving leaner and faster, rather than struggling with a large-scale digital transformation.

In the meantime, contact me to discuss how CGI can accelerate your transformation journey.