In my last two blogs, I explored how the insurance industry is facing an increasing pace of change, making it crucial to invest in innovation that transforms out-of-date processes built on legacy systems.

To meet the complex challenges that arise in our quickly evolving industry, we need to rethink our approach to change and admit that it can be difficult to accurately predict the long-term impacts of a new technology or business trend. In the case of generative artificial intelligence (GenAI), for example, it is easier to assess its initial impacts if we focus on improving what we do today.

While making current processes more efficient is easy, it requires deeper thought (and some crystal ball gazing) to anticipate the wider impacts when examining the intersection of AI and other technologies. So how can insurers create a fluid strategy that helps them successfully manage this uncertainty?

Creating a fluid strategy: The key to effectively pivoting in a volatile world

A key starting point is challenging the view that committing to a multi-year, multi-million-dollar digital transformation program is the only way to deliver change at scale.

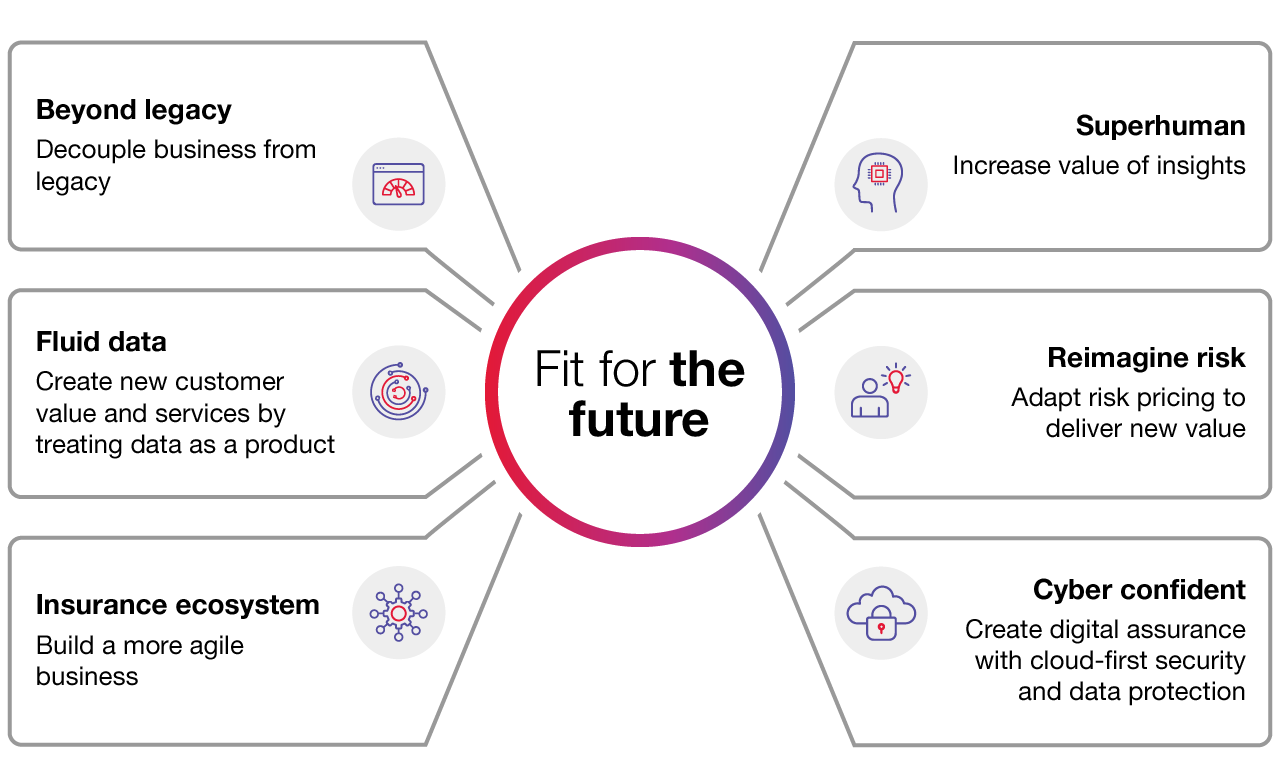

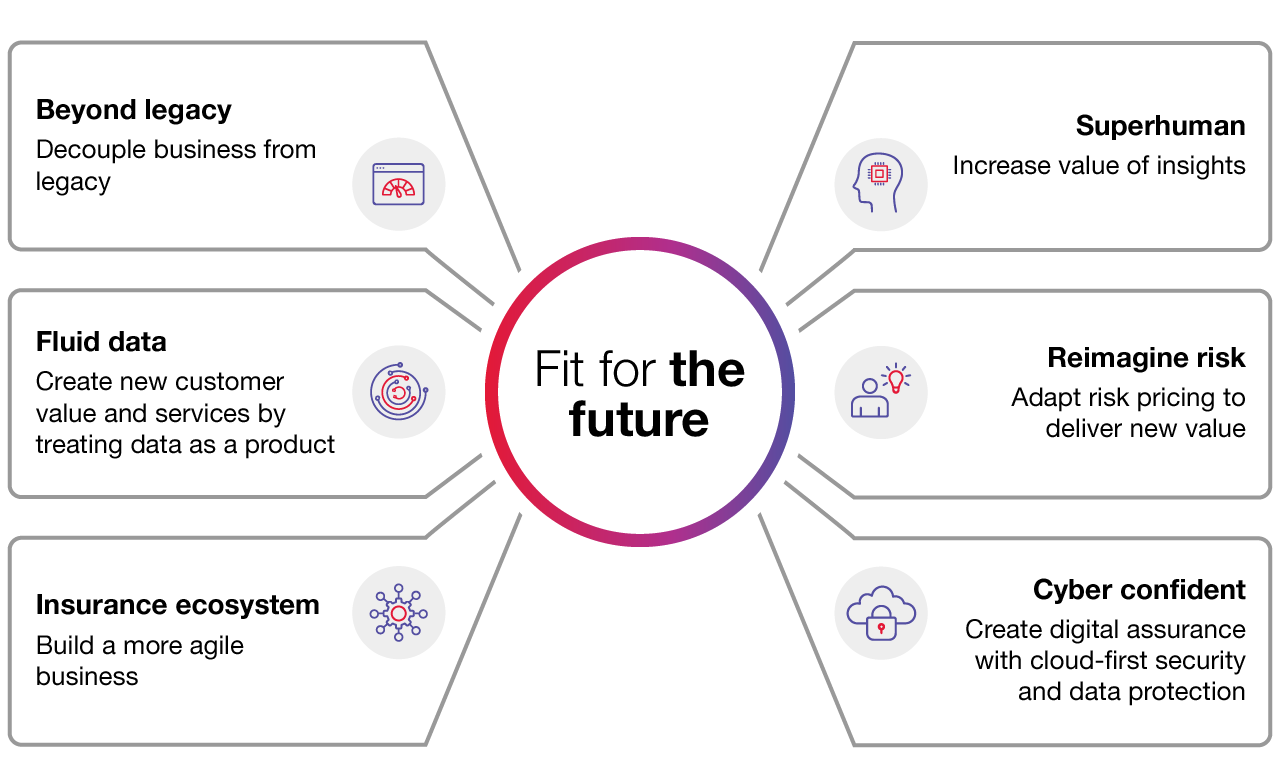

Our “fit for the future” framework helps insurers effectively pivot in a volatile world. The first step to building a more fluid strategy is to define the problem to be solved or the opportunity to be gained. While it’s important to have a plan and a north star to aim for, be prepared to accept changes to that plan. Using our framework, we aim to create an agile organization that can adapt to a faster moving future.

Our focus: Becoming “fit for the future”

In my previous blog, I introduced the the super six—key focus areas for preparing for the future of insurance. This framework covers six key strategic focus areas that allow our insurance clients to think through common challenges. Because every organization is at a different level of maturity across these areas, our model is adaptable. By analyzing all six areas and defining the problem for each, we achieve a better and more robust outcome. Following is a deeper dive into how each of these six areas can influence your business.

- 1. Beyond legacy

-

Legacy systems and processes are still stuck at the core of many insurance businesses. There is no quick fix and simply placing more layers of digital technology over old systems is not the answer. However, if we don’t innovate, the costs and constraints of legacy will continue to create barriers.

Success is more likely if we break from the traditional approach of large-scale transformation, and instead consider a green field approach. When organizations implement new technology but port across legacy processes, products, and data, they also bring the limitations of those models.

We have the chance to do better.

Change starts with challenging why we want to retain those old structures. GenAI offers an opportunity to rethink the business, but the current focus remains on using it as the latest digital layer placed over legacy processes. Decoupling the business from those legacy systems will create a more fluid business model.

Even the assumption that a traditional policy admin system should be at the center of an insurance business should be sanity checked. Most legacy systems were designed for a different world, creating limitations in the way an organization can think about its future state and become truly fluid.

At CGI, upgrading our own intellectual property (IP) legacy systems is a key a part of our digital transformation strategy. In fact, we collaborated with our low code Centre of Excellence team using OutSystems to modernize our insurance solutions and deliver business benefits faster to our clients who are using those solutions. Linking this system with a composable design allows us to break the original monolithic process into smaller blocks and create a more adaptable solution.

- 2. Superhuman

-

While there is excitement around the opportunities related to AI, a core principle for our “fit for the future” model is a focus on an insurance organization’s most important asset —its people. Too often, the starting point of an efficiency improvement program is to treat people as part of a machine to be tuned. When human nature, knowledge, experience, and interactions are concerned, the reality is much more complex.

When considering the opportunities that AI and intelligent automation offer, our approach is to start with how to improve the lives of both employees and clients. We want to ensure we have a clear view of the problems to be solved for those individuals, which is rarely just about efficiency.

It is also important to avoid simply replicating and digitizing what is already being done. Many of today’s products and processes reflect the limitations of a paper-based design. While there are opportunities to enhance current processes with a direct application of AI, many current use cases are limited to the short term.

Our focus must shift from automation to optimizing the possibilities of AI and thinking deeply about how we can make people feel superhuman by creating engaging experiences for them.

- 3. Fluid data

-

A third principle of a fluid organization is to re-think the inherent value of an organization’s data. We believe it’s important to view data as a product, something that provides insight and is used to add new value and create new services.

As AI use cases scale, clean, good quality data will become increasingly essential. The ability to move data fluidly and securely across and beyond an organization—between the client, broker, insurer, and external third parties—will be key to creating new insights and propositions. The nature of the data available to an organization is already changing, with insureds building their own smart Internet of Things (IOT) assets to drive their business efficiency. However, insureds won’t focus on the value to insurance without help. For example, access to real time satellite earth observation data or video feeds offer new ways of thinking about risk, but requires new skills to manage it.

Ultimately, the goal is to move from simply reacting once a claim has occurred, to leveraging risk mitigation strategies to proactively reduce or even prevent a claim from occurring.

- 4. Reimagine risk

-

Moving data fluidly throughout the insurance value chain and adding the superhuman capacity of AI to process it in real time creates new value. We are already working on embedding AI directly into asset and physical infrastructure monitoring that doesn’t require constant connection to the cloud, creating a cost effective way to proactively monitor risk. We’re applying AI capabilities to underwriting workbench tools that help underwriters cut through the noise of email and free up time to make better, faster, more informed decisions. Innovation, however, gets even more interesting if we look beyond the current focus on efficiency improvements.

There are opportunities for insurers to redefine the value of insurance to customers. Small Language Models (SLMs) can be trained on a narrow data set to provide more accurate answers on a specific topic. For example, an AI co-pilot trained on an insurer’s business interruption claims data could be installed to work alongside a business owner, guiding and supporting certain business decisions. By offering advice based on the insurer’s unique historical insights, it’s possible to reduce the impact of a poor decision. Insurers or brokers could consider partnerships with advisory organizations to bring together even more diverse data sets to train the co-pilot to further enhance business decisions.

Although these possibilities require changes to the traditional role of the insurer, I believe being “fit for the future” means challenging historical value propositions and approaches to partnering.

- 5. Insurance ecosystem

-

Designing a strategy that includes a partner ecosystem provides additional capacity for insurers and brokers to get to market faster. Using third parties has always been part of the insurance model. This approach works best using an open, composable business and technology model to enable more sharing across corporate boundaries. Critically, any ecosystem model must support faster adaptation when those partners are changed.

Think of each business and technology capability like a Lego brick, which can be interchanged if a new partner offers a leap in capability. Success depends on a common system for the bricks to plug together. Creating that system—building the common interface and data standards for those bricks—is where the hard work resides.

Thinking carefully about your core competitive advantages (the bricks in your own Lego bucket) is a key step in building a solid strategy that is not designed to be rigid. For instance, a partner capability used to get to market quickly may need to pivot to something built internally if it becomes central to your competitive advantage.

This need for agility is especially true for operational resilience. Right now, the rush to build key services over foundational AI models controlled by someone else presents a risk. The Lego brick analogy is a useful, if overly simplistic way to think about both business functions, as well as the supporting technology, because it illustrates how modern operating models must be composable to move toward a more fluid business model.

- 6. Cyber confident

-

The final cornerstone principle of being “fit for the future” is managing security and compliance. More and more often, data is flowing across corporate borders. At the same time, critical business processes rely on cloud-based platforms run by third parties. When boundaries are flexible and often not under our direct control, the way we think about security fundamentally changes. Today’s operational resilience requires a cybersecurity approach that goes beyond the boundary and is ready for a much more open and expanded operating environment.

Listen, adapt, and learn: Our approach to becoming “fit for the future”

Considering all six themes together as part of any strategic planning exercise provides a solid basis for challenging traditional thinking and defining a fluid operating model. If a long-term digital transformation roadmap is too rigid, it can lead to failure. The vision can be ambitious, but the strategy must deliver value quickly and be agile enough to cope with the unpredictability of a changing technology and business landscape.

Our approach accepts that major digital transformation is difficult but recognizes that organizations must address complex challenges like legacy constraints if they are going to change. We help clients build a series of shorter-term goals that enhance the agility of the business to better respond to those unpredictable turns.

Using approaches like our Managed Innovation framework, we quickly drill down to opportunities that make a difference in areas that matter to employees and clients rather than simply focusing on big technology initiatives. In our experience, most people want the drudgery removed from their day-to-day tasks, and that outcome acts as a guiding principle for our work.

We use low code tools to accelerate value delivery, which allows us to use an iterative listen, learn and adapt approach. We build enough of a solution to get initial improvements into the hands of employees and customers faster, and then adapt as we go. We also have access to our own suite of componentized building blocks and accelerators, as well an open partner ecosystem to allow us to shape the right solution for our clients, rather than shoehorn them into one created earlier.

Our goal: Keep it human, keep asking why

In the face of the excitement around technology, and especially GenAI, our team advises our clients to pause, step back, and begin with understanding the human side of a challenge before acting. The best results follow thinking deeply and effectively on the problems to solve, then acting swiftly to deliver on the goal, and honestly answering, “are we really making people's lives better?”

Contact me to discuss how your organization can create a fluid, human-centered strategy that allows your organization to be “fit for the future.”